PCI DSS Certification Simplified

Why Is PCI DSS Worth Your time?

Your customers will appreciate it. Customers want to know that their information is safe with you—not just legally but also physically. They want to know that their credit card information, medical records, and other personal information is safe from hackers. And if you’re certified as a PCI compliant business, you can prove to them that it is. Your customers will feel more confident doing business with you—and they’ll be less likely to switch to another company if something happens.

Enquire for PCI DSS Certification

What is PCI DSS Certification?

The Payment Card Industry Data Security Standard [PCI DSS] is the most widely accepted standard for protecting credit card data. The PCI DSS is a set of requirements that merchants and service providers who accept, process, store or transmit payment card data must follow to reduce their risk of being compromised by cyber criminals. It was designed by the major credit card companies in 2004 as a response to massive data breaches at dozens of major retailers and other businesses.

If you’re a business that handles credit card data, the Payment Card Industry Data Security Standard [PCI DSS] is a must-have. It’s one of the only ways to prove that your company has taken the necessary steps to protect customer data. But if your business isn’t yet certified, or if you’re considering getting certified but aren’t sure it’s worth the effort, here are some reasons why you should consider getting on board.

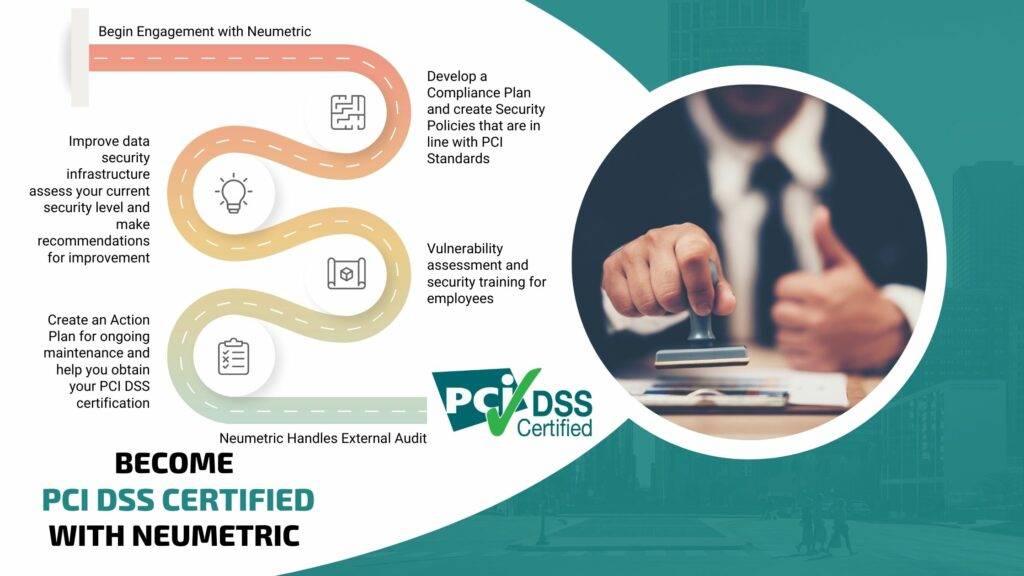

Steps involved to obtain PCI DSS Certification

Assessment & Identification

Key resource planning for certification

Auditor & Audit handling

Benefits of Neumetric's PCI DSS Certification Service

- 1. We'll work with you to develop a compliance plan and certify that our application meets all requirements.

- 3. We'll help you improve your data security infrastructure by providing best-practice guidance on how to protect customer information

- 5. We'll perform a vulnerability assessment and integrate any needed changes into our system.

- 7. We'll help you create an action plan for ongoing maintenance and improve overall data security across your organization

- 2. We'll help you create security policies that are in line with PCI Standards.

- 4. We'll assess your current security level and make recommendations for improvement.

- 6. We'll train your employees on how to use our application effectively, ensuring they know how to protect customer data when using our services.

- 8. We'll also help you obtain your PCI DSS Certification, which can be a lengthy and difficult process.

Our clients

Knowledge Hub

Other InfoSec Services

ISO 27001 Certification

ISO 27001 Certification Service will help you implement the necessary frameworks to make you ISO compliant and obtain ISO 27001 Certification.

SOC 2 Report

We will implement all 5 trust Principles at your Organisation & help you become SOC 2 Compliant in a few months & get your SOC 2 Report from the best Auditors.

EU GDPR Compliance

EU GDPR Compliance Service will help you implement all steps and frameworks in your organisation to become EU GDPR compliant in just a few months.

Frequently Asked Questions

The Payment Card Industry Data Security Standard [PCI DSS] is a set of security standards designed to protect cardholders' data. Any company that stores, processes, or transmits credit card information must be PCI DSS compliant. There are many benefits of PCI DSS certification, including improved data security, reduced fraud costs, and enhanced customer trust. PCI DSS compliance is also a requirement of many credit card companies and banks. If your company accepts credit cards, PCI DSS certification is an important step in ensuring the security of your customers' data.

Neumetric's PCI DSS Certification Process takes 7 - 9 months depending on the size of the organization.

Neumetric offers a wide range of Cyber security compliance and certification services that are not limited to PCI DSS Certification. The other services include ISO 27001 Certification, SOC 2 Report, ISO 27701 Compliance, HIPAA Compliance, NIST Compliance, CSA Star Compliance and CCPA Compliance.

Apart from these Neumetric also offers Technical Security Services such as Web and Mobile Application Vulnerability Assessment and Penetration Testing, Cloud and API Vulnerability Assessment and Penetration Testing, etc.

PCI DSS compliance assessment should be conducted annually.

The PCI DSS is a set of guidelines that helps companies adhere to cybersecurity standards in order to prevent data breaches. These standards are determined by the Payment Card Industry Security Standards Council [PCI SSC], and they're updated every three years.

As such, you'll need to perform an annual assessment of your compliance with these standards in order to ensure that you're doing everything possible to keep your customers' sensitive information safe.

The short answer is yes. If you're a merchant or payment processor, then you're required to have a PCI DSS-compliant security program in place.

If you do not follow these guidelines, you could be subject to fines and penalties. Additionally, if a security breach occurs in your business, then customers may not trust you with their sensitive financial information anymore.

GRC Ecosystem

- Document Management

- Audit Management

- Risk Management

- Vulnerability Management

- Inventory Management

- Compliance Management

- Continuity Management

- Incident Management

- Education Program

Technical Security

Company