Table of Contents

ToggleIntroduction

PCI DSS, which stands for Payment Card Industry Data Security Standard, is a set of security requirements that aim to protect Payment Card Data from theft & fraud. It was developed by major Payment Card brands such as Visa, Mastercard & American Express & it is mandatory for any business that processes, stores or transmits Payment Card information.

Achieving Compliance with PCI DSS is not only important for the security of Payment Card Data, but it also helps businesses to build trust with their customers & avoid potential financial & legal penalties. However, it’s crucial to understand the scope of the Standard’s applicability to ensure that your business is complying with all the necessary requirements.

In this Journal, we’ll explore whether PCI DSS applies to your business in India & provide guidance on the steps you need to take to achieve Compliance. So, if you’re a business owner in India that processes Payment Card information, read on to learn more about PCI DSS & its applicability to your Organisation.

Understanding PCI DSS Applicability

Understanding the scope of PCI DSS applicability is crucial to determine whether your business needs to comply with this Standard. PCI DSS has twelve (12) main requirements, which include implementing firewalls, encrypting Payment Card Data & regularly monitoring & testing security systems.

Additionally, the Standard has different levels of Compliance, which are based on the volume of Payment Card transactions processed by the business. Level 1, which applies to businesses that process more than six (6) million Payment Card transactions per year, has the most stringent requirements, while Level 4, which applies to businesses that process fewer than 20,000 e-commerce transactions or up to one (1) million transactions in other channels per year, has the least strict requirements.

PCI DSS Compliance applies to both merchants & service providers that handle Payment Card Data. Merchants are businesses that accept Payment Cards as payment for goods & services, while service providers are businesses that process Payment Card Data on behalf of merchants or other service providers. Examples of service providers include payment gateways, hosting providers & cloud service providers.

It’s important to note that even if a business outsources its payment processing to a service provider, the business still has some responsibility for ensuring that the service provider is compliant with PCI DSS. This is because any breach of Payment Card Data can ultimately harm both the business & its customers. If you’re unsure whether your business needs to comply with PCI DSS, it’s recommended to seek the guidance of PCI DSS experts such as Neumetric, to ensure that you’re taking the necessary steps to protect Payment Card Data.

Factors that Determine PCI DSS Applicability

Determining whether an Organisation must comply with PCI DSS depends on several factors, including the type of Payment Card Data it handles & the volume of Payment Card transactions it processes. In general, any Organisation that stores, processes or transmits Payment Card Data is subject to PCI DSS requirements.

The types of Payment Card Data that trigger PCI DSS requirements include Cardholder Data, sensitive authentication data & service code. Cardholder Data includes the Permanent Account Number [PAN], Cardholder name & expiration date. Sensitive authentication data includes the Card Verification Value [CVV] or Card Verification Code [CVC], which are the three-digit or four-digit numbers printed on the back or front of the Payment Card. Service code is the three-digit code on the magnetic stripe of the Payment Card that indicates the card’s intended use.

Acquirers & payment processors also play a role in determining PCI DSS applicability. Acquirers are financial institutions that process Payment Card transactions on behalf of merchants. Payment processors are third-party service providers that facilitate Payment Card transactions between merchants & acquirers. These entities are responsible for ensuring that their merchants or clients comply with PCI DSS requirements.

Acquirers may require their merchants to provide proof of PCI DSS Compliance as a condition of doing business. They may also conduct regular Audits or assessments to ensure that their merchants are complying with PCI DSS requirements. Payment processors are also required to comply with PCI DSS, as they handle Payment Card Data on behalf of merchants & may be held responsible for any data breaches that occur.

Consequences of Non-Compliance

Failing to comply with PCI DSS can have serious consequences for businesses. Non-compliance can result in data breaches, which can lead to financial & reputational damage. In addition, non-compliance can also result in legal & financial penalties.

One of the most significant risks associated with Payment Card Data breaches is financial loss. When a business suffers a data breach, it can be liable for fraudulent charges made on Payment Cards as well as the cost of investigating & responding to the breach. This can be a significant financial burden, especially for small businesses.

Reputational damage is another risk associated with Payment Card Data breaches. When customers’ Payment Card Data is compromised, it can lead to a loss of trust & confidence in the business. This can result in decreased sales & difficulty acquiring new customers.

In addition to financial & reputational costs, non-compliance with PCI DSS can also result in legal & financial penalties. Payment card brands can fine businesses that fail to comply with PCI DSS & in some cases, businesses may be required to pay for the costs associated with the investigation & resolution of a data breach.

It’s essential for businesses that handle Payment Card Data to take the necessary steps to comply with PCI DSS & protect their customers’ data. If you’re unsure whether your business is compliant with PCI DSS, it’s recommended to seek the guidance of PCI DSS experts such as Neumetric to ensure that you’re taking the necessary steps to protect Payment Card Data.

Steps to Achieving PCI DSS Compliance

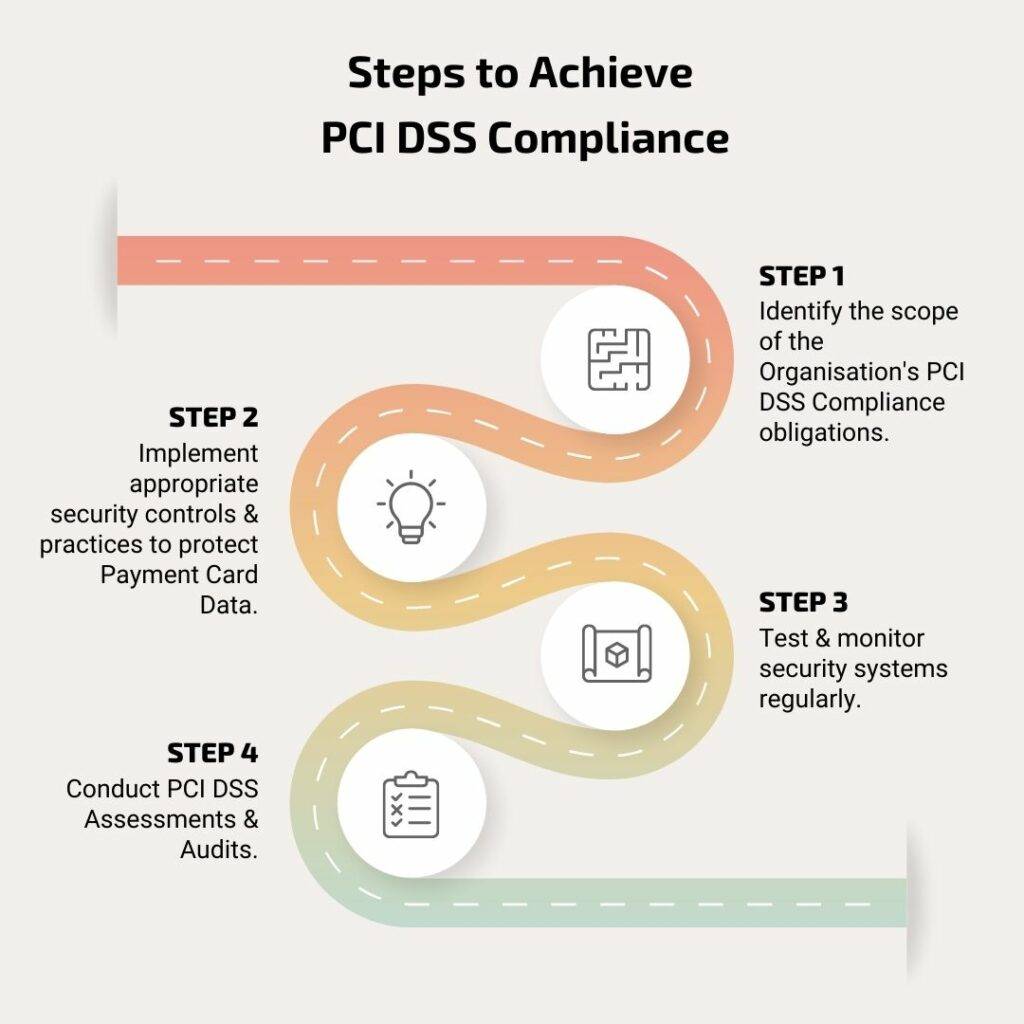

Achieving PCI DSS Compliance requires Organisations to take a series of steps to ensure that they are meeting the requirements of the Standard. The first step is to identify the Scope of the Organisation’s PCI DSS Compliance obligations. This involves determining which systems & processes are involved in Payment Card Data handling, storage & transmission.

Once the Scope has been identified, Organisations must implement appropriate security controls & practices to protect Payment Card Data. This may involve implementing firewalls, encrypting data & ensuring that only authorised individuals have access to Payment Card Data. It’s important to note that the specific security controls & practices required will vary depending on the Organisation’s level of Compliance & the specific requirements of the Standard.

Regularly testing & monitoring security systems is another critical step in achieving PCI DSS Compliance. This involves conducting regular Vulnerability Assessments & Penetration Tests [VAPT] to identify & remediate any security weaknesses in the Organisation’s systems & processes.

PCI DSS Assessments & Audits play a critical role in achieving Compliance. Organisations may need to undergo a Self-Assessment Questionnaire [SAQ] or a formal Audit by a Qualified Security Assessor [QSA] to demonstrate Compliance with the Standard. These Assessments provide an independent evaluation of the Organisation’s Compliance with PCI DSS & identify any areas where improvements are needed.

It’s important to note that achieving & maintaining PCI DSS Compliance is an ongoing process. Organisations must regularly review & update their security controls & practices to ensure that they continue to meet the requirements of the Standard. This may involve implementing new technologies or processes as well as providing regular training to employees on security best practices.

Conclusion

In this Journal, we discussed the applicability of PCI DSS to businesses in India. We covered the key requirements of PCI DSS, the different levels of compliance based on transaction volume & the types of Organisations that must comply with PCI DSS. We also discussed the factors that determine PCI DSS applicability, including the types of Payment Card Data that trigger PCI DSS requirements & the role of acquirers & payment processors.

It’s important for businesses to understand the scope of PCI DSS applicability & take the necessary steps to achieve Compliance. By complying with PCI DSS, businesses can ensure the security of Payment Card Data & protect themselves & their customers from fraud or identity theft.

If you’re a business that handles Payment Card Data, it’s crucial to understand whether you need to comply with PCI DSS & take steps to achieve Compliance if necessary. This includes implementing appropriate security measures, conducting regular Assessments & Audits & working with trusted service providers. By taking these steps, you can ensure the security of Payment Card Data & build trust with your customers.

FAQs:

Who is PCI applicable to?

Payment Card Industry [PCI] compliance is applicable to any Organisation that processes, stores or transmits credit card information. This includes merchants, banks, payment processors & service providers that handle credit card data. PCI Compliance requirements are established by the Payment Card Industry Security Standards Council [PCI SSC] & are mandatory for all businesses that accept Credit Card payments. Failure to comply with PCI requirements can result in hefty fines, legal liabilities & damage to a Company’s reputation. Therefore, it is crucial for any Organisation that handles Credit Card information to ensure they are PCI Compliant.

Does PCI DSS apply to service providers?

Yes, the Payment Card Industry Data Security Standard [PCI DSS] applies to service providers that store, process or transmit Cardholder Data on behalf of merchants or other service providers. In fact, service providers have their own set of requirements under PCI DSS, called the Service Provider Level Requirements, which include Compliance validation & reporting obligations. The requirements for service providers are intended to ensure that they maintain a secure environment for Cardholder Data & protect it from unauthorised access or theft.

What 4 things does PCI DSS cover?

The Payment Card Industry Data Security Standard [PCI DSS] covers the following four areas:

- Network security

- Physical security

- Cardholder Data protection

- Security management

Is PCI DSS Compliance mandatory in India?

Yes, PCI DSS Compliance is mandatory in India for any entity that processes, stores or transmits Payment Card Data. The Reserve Bank of India [RBI] has mandated compliance with the PCI DSS Standard for all banks, financial institutions & payment gateway providers that offer electronic payment services in India. Additionally, the PCI Security Standards Council [PCI SSC] recommends that all merchants who accept Payment Cards also comply with the PCI DSS Standard. Failure to comply with PCI DSS can result in fines, penalties & reputational damage. It is important for Organisations to prioritise PCI DSS Compliance to protect their customers’ Payment Card Data & maintain their own security posture.

How do I know if a Company is PCI Compliant?

- Check the Company’s website: Many Companies that are PCI Compliant will display the PCI DSS Compliance logo on their website.

- Contact the Company: You can ask the Company directly if they are PCI Compliant & request to see their Compliance Certificate or Validation Report.

- Check with the Payment Card brands: The major Payment Card brands, such as Visa, Mastercard, American Express & Discover, maintain lists of PCI Compliant service providers on their websites.

- Check with a Qualified Security Assessor [QSA]: A QSA is a certified professional who is authorised by the PCI SSC to assess a Company’s Compliance with the PCI DSS Standard. You can ask a QSA if they have assessed the Company’s Compliance Status & what their findings were.

What happens if a Company is not PCI Compliant?

If a Company is not PCI Compliant, it can face significant financial & reputational consequences. Here are some of the potential consequences:

- Fines: The Payment Card brands can impose fines on non-compliant Companies, which can range from a few hundred dollars to hundreds of thousands of dollars per month.

- Increased transaction fees: Non-compliant Companies may also be subject to higher transaction fees from Payment Card brands or payment processors.

- Legal action: Customers or Payment Card brands may take legal action against non-compliant Companies if a data breach occurs & Cardholder Data is compromised.

- Loss of business: Non-compliant Companies may lose business from customers who are concerned about the security of their Payment Card Data.

- Damage to reputation: A data breach or non-compliance with the PCI DSS Standard can damage a Company’s reputation & erode customer trust.