Multiple Compliances? Single Solution!

Achieve certification, privacy & governance goals

RELIABLE & EFFICIENT Security & Compliance…

Trusted By

Success Stories

5+

Years

40+

Clients

350+

Audits

160+

Scans

52k+

Controls

Security & Compliance are an ongoing journey that needs to be enabled by a reliable partner...

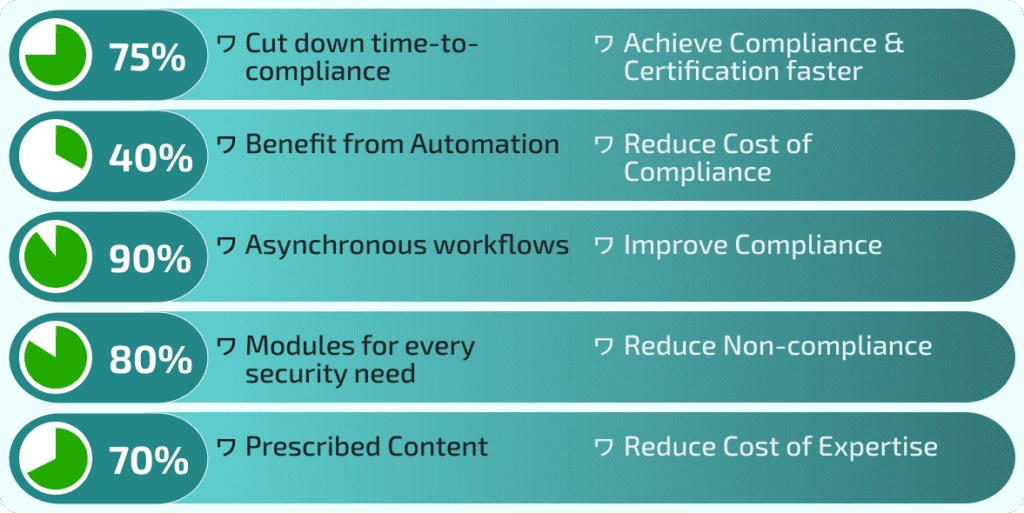

Ease your Certification & Compliance Journey…

Achieving Security Certification does not need to be tough or costly

- Automate Policies

- Optimise Audits

- Educate People

- Track Incidents

- Test Continuity

- Conduct Scans

- Manage Risks

- Earn Certification

Technical Security

Get the entire range of your IT Assets scanned for vulnerabilities…

- Scan IT Assets

- Find Vulnerabilities

- Remediate and Certify

Cybersecurity Ecosystem

Employ our feature-rich multi-modular microservices-driven cloud-based suite of SaaS solution for all your compliance needs…

Audit Management

Prescribed Controls List

Automated Audit Report

Heuristics-based Scores

Automated Audit Report

Heuristics-based Scores

Document Management

Instant Generation

Approval Workflows

In-built Editing Features

Approval Workflows

In-built Editing Features

Compliance Management

Priority-based Tracking

Automated Alerts

Automated Escalations

Automated Alerts

Automated Escalations

Education Management

Prescribed Modules

Mandatory Assessments

Automated Scheduling

Mandatory Assessments

Automated Scheduling

Continuity Management

Predefined Scenarios

Recovery History

Automated Reports

Recovery History

Automated Reports

Incident Management

Severity-based Priority

Evidence Collection

Incident Reports

Evidence Collection

Incident Reports

Risk Management

Predefined Risk Matrix

Automated Decisions

Risk Acceptance Flow

Automated Decisions

Risk Acceptance Flow

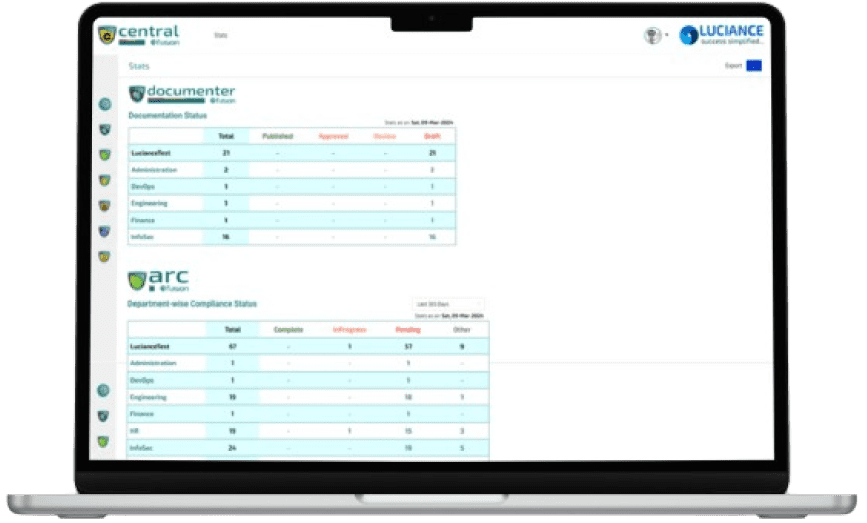

Centralised Control

Realtime Statistics

Relevant Dashboards

Stats Exports

Relevant Dashboards

Stats Exports

Comprehensive Solutions

Cybersecurity is served better when necessary services are provided in a single solution from a single provider…

Achieve

Compliance

Latest Journal Posts…

How to create a Cybersecurity Incident Response Plan [CIRP] Template?

In an era where digital threats loom larger by the day, the significance of a...

How to implement Cybersecurity Governance Solutions in the organization?

Introduction As the digital realm continues to evolve, cybersecurity stands out as a pressing issue...

How to conduct Secure Coding Training for Developers in the organization?

Introduction In today’s digital landscape, where cybersecurity risks are always growing, developers’ responsibility in protecting...